- Published on

ESOP Taxation in India and its impact

- Authors

- Name

- Vinayak Ganapuram

- @vinayakkg

Introduction

This is a post on ESOP taxation in India.

Employees joining startups are offered ESOPs as an award to employees in order to retain top talent & also used by start-ups that cannot afford to pay high salaries to employees in the initial phase. It acts as a motivational tool for employees, making them feel responsible for the performance of the company after owning a stake in it.

ESOP Taxation 💰--

In case you are unfamiliar with ESOP stages, you may read it here. ESOPs when exercised can be beneficial to the employee as company grows and can lead to greater financial outcomes.

However, there are few caveats with respect to ESOP taxation in India. As per the latest ESOP policy amended by Finance Act, 2023, you need to pay 30% tax per below computation

(FMV(Fair Market Value) - Share Price(if paid by employee)) * No of Shares Exercised

The above tax is applicable on whichever event happens first, post ESOP exercise

- On the expiry of 48 months from the end of the assessment year in which securities are allotted under ESOPs;

- From the date the assessee ceases to be an employee of the organization; or

- From the date of sale of securities allotted under ESOP.

Outcome and Impact

Of many startups that exist, very few succeed of which even very few make it to an exit - a liquidation event which can either be a buy-back/IPO/Secondary sale/acquisition/merger. Most of the employees exercising ESOP will fall under first 2 events i.e. either you exceed the 48 months period (no liquidation in 48 months) or you are not with the company anymore (things change rapidly with startups) and that means outgoing tax is actual and incoming gain is notional(on paper). And in the worst case if the liquidation fails or liquidation value is less than tax paid - you can only adjust tax paid against capital gains(short or long term). In short, you may not end up getting much basis your situation. In the best case, you may be able to save all tax paid by offsetting against capital gains which is much lesser than the growth due to compounding by investing the same amount in safer/better yielding options.

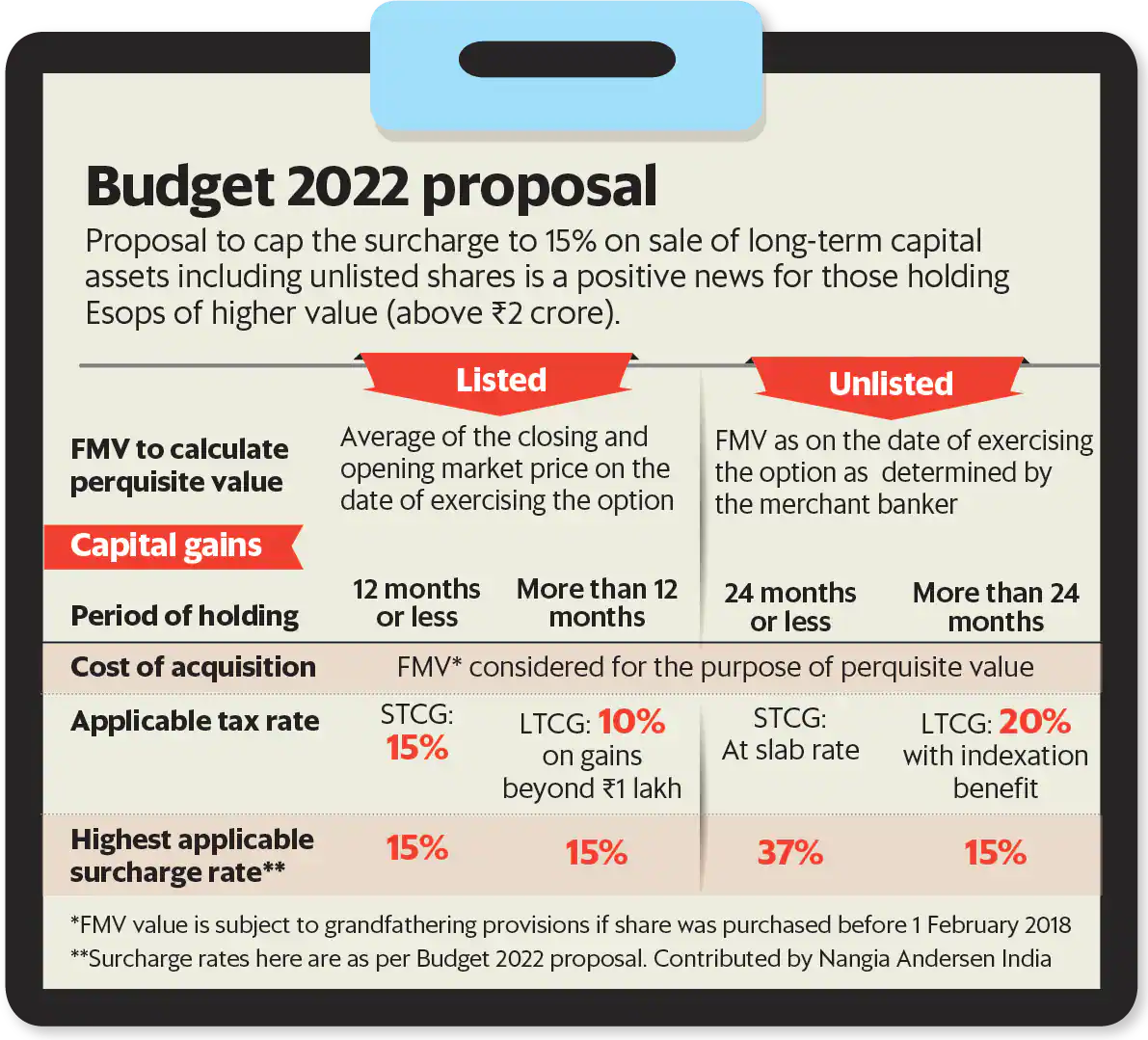

If you are senior enough/have worked for sometime - effective taxation from gains are in the range of 35-42%, where as LTCG(Long Term Captial Gain) that is generally applicable to MF's/equities, et al. would be ~20%

Due to the above reasons, most employees inspite of being awarded high ESOP's ending up passing it up. High taxation needs to be paid out of pocket without any real gain at that point in time.

Image Courtsery: livemint.com (HT Media Ltd)

Change Needed 🥺🙋🏼

In order to solve the above problem, ESOP taxation in India needs to change so that the employees taking risk with startups and backing themselves may get benefitted in the truest sense.

Following are 2 suggestions

- ESOP should be taxed on liquidation event, not anytime before like exercise

- ESOP gains should be treated and taxed as other LTCG(20%)

Its my humble request to Finance Ministry to change this so more deserving employees can experience the possible finanical upside.

References

Getting ESOP as salary package? Know about ESOP Taxation

Budget 2023: Scope of ESOP taxation reforms for start-ups was a miss